Hi everyone,

Welcome to all our new subscribers who joined us this week! We're thrilled to have you as part of The Weekly Pill community. Your readership means the world to us. If you could kindly share this newsletter with your friends or coworkers, we would greatly appreciate your support! This resource holds value for a wide range of individuals, including venture capitalists, students, professionals at all levels within pharmaceutical companies, and anyone with a curious mindset eager to learn. Your assistance in this endeavor is greatly appreciated.

I sincerely hope you enjoy reading our newsletter and that it adds value to your understanding of the biotech world. Wishing each of you a blessed week ahead, and I look forward to connecting with you all again next week for another update.

If you really enjoy what we're doing here, consider becoming a paid subscriber to encourage us and gain access to the paid section, which includes insights on upcoming catalysts next week, the most shorted biotech stocks, earnings, market comments, notes and M&A comments. Now let’s dive into last week recap!

Table of contents

How the market performed this week

Licenses / Partnerships

Clinical trials

Financing

RIF

Disease of the week

What I’ve read this week

Paid Content Section

Upcoming Catalysts Next Week

Reminders

Biotech Valuation

Most Shorted Biotech Stock as of This Week

Market

Notes from analysts

Venture Capital Market

M&A

How the market performed this week

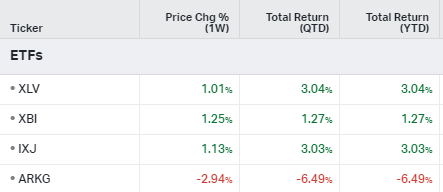

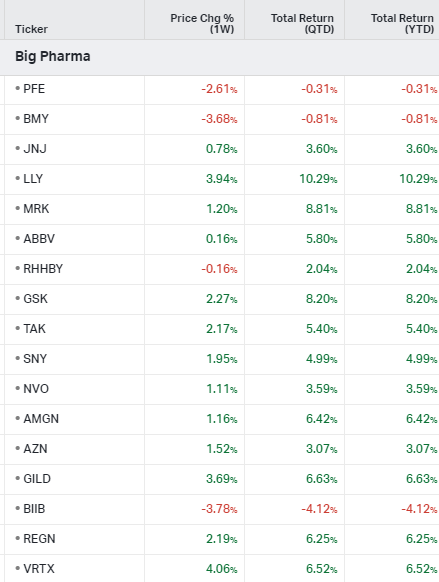

ETFs

Gene Therapy

RNA Therapy

Big Pharma

Gainers / Decliners this week in biotech

News of the week

Licenses/Partnerships

Precision BioSciences, Inc.

Symbol: DTIL

Event Phase: Preclinical

Drug: Azer-cel

Indication: Autoimmune Disorders

Lead Indication: N

Molecule: Cellular Allogeneic Chimeric Antigen Receptor T-cells (CAR-T), Cluster of Differentiation 19 (CD19), Immune System, Stem Cells/Other Cell Therapies

Target: Not specified

LOA: Not specified

Partner Companies: Imugene Limited (IMU), Takeda Pharmaceutical Co. Ltd. (TAK), TG Therapeutics, Inc. (TGTX)

Perspective Therapeutics, Inc.

Symbol: CATX

Event Phase: II

Drug: VMT-??-NET

Indication: Neuroendocrine Tumors (NET) - Imaging

Lead Indication: N

Molecule: Small Molecule Melanocortin (MC) receptors, Somatostatin Receptors

Target: 11%

Partner Companies: Lantheus Holdings, Inc. (LNTH)

Source Link: Lantheus Expands Radiopharmaceutical Oncology Pipeline via Strategic Agreements with Perspective Therapeutics

Immunome Inc.

Symbol: IMNM

Event Phase: Preclinical

Drug: ZPC-21

Indication: Solid Tumors

Lead Indication: N

Molecule: Monoclonal Antibody ROR-1/NTRKR1

Target: Not specified

LOA: Not specified

Partner Companies: Zentalis Pharmaceuticals (ZNTL)

Source Link: Immunome Inc.

HilleVax, Inc.

Symbol: HLVX

Event Phase: IND

Drug: HIL-216

Indication: Norovirus

Lead Indication: Y

Molecule: Vaccine Norovirus

Target: Not specified

LOA: Not specified

Partner Companies: Not specified

Deciphera Pharmaceuticals, Inc.

Symbol: DCPH

Event Phase: Approved

Drug: Qinlock

Indication: Gastrointestinal Stromal Tumor (GIST)

Lead Indication: N

Molecule: Small Molecule KIT/c-KIT, Platelet-derived growth factor alpha (PDGFa)

Target: 100%

Partner Companies: Specialised Therapeutics, Zai Lab Ltd. (ZLAB)

Source Link: Deciphera Pharmaceuticals, Inc.

Ascendis Pharma A/S

Symbol: ASND

Event Phase: Approved

Drug: Skytrofa

Indication: Short Stature / Growth Hormone Deficiency

Lead Indication: Y

Molecule: Protein Growth hormone receptor (GHR)

Target: 100%

Partner Companies: Royalty Pharma plc (RPRX), Specialised Therapeutics, Visen Pharmaceuticals

Harpoon Therapeutics

Symbol: HARP

Event Phase: II

Drug: HPN328

Indication: Small Cell Lung Cancer (SCLC)

Lead Indication: Y

Molecule: Monoclonal Antibody Delta-like 3 (DLL3), Human Serum Albumin (HSA), T lymphocytes, Tumor Cells

Target: 11%

Partner Companies: Not specified

Source Link: Merck to Acquire Harpoon Therapeutics Further Diversifying Oncology Pipeline

Pulmatrix, Inc.

Symbol: PULM

Event Phase: Development Outside U.S.

Drug: Pulmazole

Indication: Aspergillosis

Lead Indication: Y

Molecule: Small Molecule Ergosterol biosynthesis

Target: Not specified

Partner Companies: Cipla Limited (CIPLA)

Artelo Biosciences, Inc.

Symbol: ARTL

Event Phase: Preclinical

Drug: ART26.12

Indication: Chemotherapy Induced Peripheral Neuropathy (CIPN)

Lead Indication: Y

Molecule: Small Molecule Fatty Acid Binding Protein (FABP)

Target: Not specified

Partner Companies: Not specified

Ambrx Biopharma, Inc.

Symbol: AMAM

Event Phase: II

Drug: ARX788

Indication: Solid Tumors

Lead Indication: N

Molecule: Monoclonal Antibody HER2/neu or ErbB-2, Microtubules (Tubulin)

Target: 11%

Partner Companies: Zhejiang Medicine Co., Ltd. (600216)

Source Link: Ambrx Announces Sale to Johnson & Johnson

Ambrx Biopharma, Inc.

Symbol: AMAM

Event Phase: Preclinical

Drug: ARX788

Indication: Gastric Cancer

Lead Indication: N

Molecule: Monoclonal Antibody HER2/neu or ErbB-2, Microtubules (Tubulin)

Target: Not specified

Partner Companies: Zhejiang Medicine Co., Ltd. (600216)

Source Link: Ambrx Announces Sale to Johnson & Johnson

Ambrx Biopharma, Inc.

Symbol: AMAM

Event Phase: II

Drug: ARX788

Indication: HER2+ Breast Cancer

Lead Indication: N

Molecule: Monoclonal Antibody HER2/neu or ErbB-2, Microtubules (Tubulin)

Target: 11%

Partner Companies: Zhejiang Medicine Co., Ltd. (600216)

Source Link: Ambrx Announces Sale to Johnson & Johnson

Ambrx Biopharma, Inc.

Symbol: AMAM

Event Phase: II

Drug: ARX517

Indication: Prostate Cancer

Lead Indication: N

Molecule: Monoclonal Antibody Prostate-specific Membrane Antigen (PSMA)

Target: 11%

Partner Companies: Not specified

Source Link: Ambrx Announces Sale to Johnson & Johnson

Ambrx Biopharma, Inc.

Symbol: AMAM

Event Phase: I

Drug: ARX305

Indication: Cancer

Lead Indication: Y

Molecule: Monoclonal Antibody Cluster of Differentiation 70 (CD70)

Target: 5%

Partner Companies: Zhejiang Medicine Co., Ltd. (600216)

Source Link: Ambrx Announces Sale to Johnson & Johnson

Ambrx Biopharma, Inc.

Symbol: AMAM

Event Phase: Preclinical

Drug: ReCODE/EuCODE Program (Ambrx/Beigene)

Indication: Undisclosed

Lead Indication: Y

Molecule: Protein Unknown

Target: Not specified

Partner Companies: BeiGene, Ltd. (BGNE)

Source Link: Ambrx Announces Sale to Johnson & Johnson

Ambrx Biopharma, Inc.

Symbol: AMAM

Event Phase: Preclinical

Drug: ARX102

Indication: Cancer

Lead Indication: N

Molecule: Small Molecule IL-2 (Interleukin-2)

Target: Not specified

Partner Companies: Sino Biopharmaceutical Limited (1177)

Source Link: Ambrx Announces Sale to Johnson & Johnson

Clinical trials (LOA=likelihood of approval)

Aclaris Therapeutics, Inc. (ACRS)

Event Phase: II

Drug: ATI-1777

Indication: Atopic Dermatitis (Eczema)

Molecule: Small Molecule

Target: JAK/STAT

LOA: 19%

Partner Companies: Pediatrix Therapeutics, Inc.

VYNE Therapeutics Inc. (VYNE)

Event Phase: I

Drug: VYN201

Indication: Vitiligo

Molecule: Small Molecule

Target: BET Proteins/Bromodomains

LOA: 23%

Partner Companies: Tay Therapeutics Ltd.

BridgeBio Pharma, Inc. (BBIO)

Event Phase: NDA/BLA

Drug: Acoramidis

Indication: Transthyretin Amyloid Cardiomyopathy (ATTR-CM, Wild Type Or Hereditary)

Molecule: Small Molecule

Target: Transthyretin (TTR)

LOA: 88%

Partner Companies: AstraZeneca PLC (AZN)

Bristol Myers Squibb Company (BMY)

Event Phase: Approved

Drug: Augtyro

Indication: Non-Small Cell Lung Cancer (NSCLC)

Molecule: Small Molecule

Target: Anaplastic lymphoma kinase (ALK), ROS kinase, Src Kinase Family, Trk (Tropomyosin Receptor Kinase) Receptors

LOA: 100%

Partner Companies: Zai Lab Ltd. (ZLAB)

Defence Therapeutics Inc. (DTC)

Event Phase: Preclinical

Drug: AccuTOX-Chitosan

Indication: Lung Cancer - Unspecified

Molecule: Small Molecule

Target: Cluster of Differentiation 47 (CD47), Cytotoxic T-Lymphocyte Antigen 4 (CTLA4), Programmed death-1 receptor (PD-1)

Tonix Pharmaceuticals Holding Corp. (TNXP)

Event Phase: III

Drug: Tonmya

Indication: Fibromyalgia

Molecule: Small Molecule

Target: Alpha 2 Adrenergic Receptor, Serotonin 5-HT2A receptor

LOA: 36%

NGM Biopharmaceuticals, Inc. (NGM)

Event Phase: II

Drugs: NGM120, NGM707

Indication: Solid Tumors

Molecule: Monoclonal Antibody

Target: GDNF Receptor Alpha-like (GFRAL), Immunoglobulin, Leukocyte Immunoglobulin-Like Receptor B1 (LILRB1) / Immunoglobulin-Like Transcript 2 (ILT2)

LOA: 11%

Partner Companies: Merck & Co., Inc. (MRK)

SELLAS Life Sciences Group, Inc. (SLS)

Event Phase: II

Drug: SLS009

Indication: Acute Myelogenous Leukemia (AML)

Molecule: Small Molecule

Target: Cyclin Dependent Kinase 9 (CDK-9)

LOA: 11%

Partner Companies: GenFleet Therapeutics

Protagonist Therapeutics, Inc. (PTGX)

Event Phase: III

Drug: Rusfertide

Indication: Polycythemia Vera (PV)

Molecule: Peptide

Target: Hepcidin

LOA: 46%

BioCryst Pharmaceuticals, Inc. (BCRX)

Event Phase: Preclinical

Drug: BCX17725

Indication: Congenital Ichthyosis

Molecule: Protein

Target: Kallikrein Related Peptidase 5 (KLK5)

Cellectar Biosciences, Inc. (CLRB)

Event Phase: II

Drug: CLR 131

Indication: Waldenstrom Macroglobulinemia (WM) / Lymphoplasmacytic Lymphoma (LPL) - NHL

Molecule: Small Molecule

Target: Lipid Rafts, PI3K/AKT pathway

LOA: 11%

Xilio Therapeutics, Inc. (XLO)

Event Phase: I

Drug: XTX301

Indication: Solid Tumors

Molecule: Protein

Target: IL-12 (Interleukin-12) and IL-12 receptor, Immune System

LOA: 5%

Cybin Inc. (CYBN)

Event Phase: Development Outside U.S.

Drug: SPL028

Indication: Major Depressive Disorder (MDD)

Molecule: Small Molecule

Target: Unknown

OKYO Pharma Limited (OKYO)

Event Phase: II

Drug: OK-101

Indication: Dry Eye (Ophthalmology)

Molecule: Peptide

Target: ChemR23, GPR1

LOA: 24%

Summit Therapeutics plc (SMMT)

Event Phase: III

Drug: SMT112

Indication: Non-Small Cell Lung Cancer (NSCLC)

Molecule: Polyclonal Antibody

Target: Immune System, Programmed death-1 receptor (PD-1), VEGF (Vascular endothelial growth factor)

LOA: 44%

Partner Companies: Akeso Inc.

Novo Nordisk A/S (NVO)

Event Phase: III

Drug: IcoSema

Indication: Diabetes Mellitus, Type II

Molecule: Peptide

Target: GLP-1 Receptor, Insulin Receptor

LOA: 65%

G1 Therapeutics Inc. (GTHX)

Event Phase: III

Drug: Cosela

Indication: Triple-Negative Breast Cancer (TNBC)

Molecule: Small Molecule

Target: Cyclin Dependent Kinase 4 (CDK-4), Cyclin Dependent Kinase 6 (CDK-6)

LOA: 49%

Partner Companies: Boehringer Ingelheim GmbH, Simcere Pharmaceutical Group (2096)

Atea Pharmaceuticals, Inc. (AVIR)

Event Phase: II

Drug: Bemnifosbuvir + Ruzasvir

Indication: Hepatitis C (HCV) (Antiviral)

Molecule: Small Molecule

Target: HCV Polymerase (NS5B) - Allosteric binding sites (Non-nucleosides), Non-structural 5A protein (NS5A)

LOA: 23%

Partner Companies: Merck & Co., Inc. (MRK)

Coherus BioSciences, Inc. (CHRS)

Event Phase: Development Outside U.S.

Drug: Loqtorzi

Indication: Triple-Negative Breast Cancer (TNBC)

Molecule: Monoclonal Antibody

Target: Immune System, Programmed death-1 receptor (PD-1)

Partner Companies: AstraZeneca PLC (AZN), Excellmab Pte. Ltd., Hikma Pharmaceuticals plc (HIK), Shanghai Junshi Biosciences Co., Ltd. (1877)

Affimed N.V. (AFMD)

Event Phase: II

Drug: AFM24

Indication: Solid Tumors

Molecule: Monoclonal Antibody

Target: Cluster of Differentiation 16 (CD16), EGFR (Epidermal Growth Factor Receptor)

LOA: 11%

Clene, Inc. (CLNN)

Event Phase: II

Drug: CNM-Au8

Indication: Multiple Sclerosis (MS)

Molecule: Small Molecule

Target: Myelin

LOA: 12%

Novartis AG (NVS)

Event Phase: Approved

Drug: Scemblix

Indication: Chronic Myelogenous Leukemia (CML)

Molecule: Small Molecule

Target: BCR-ABL Fusion Protein

LOA: 100%

Bayer AG (BAYN)

Event Phase: III

Drug: Elinzanetant

Indication: Menopause (including Hormone Replacement Therapy [HRT])

Molecule: Small Molecule

Target: Neurokinin Receptor

LOA: 63%

Vertex Pharmaceuticals Incorporated (VRTX)

Event Phase: III

Drug: VX-548

Indication: Postsurgical Pain

Molecule: Small Molecule

Target: Sodium Channel Nav1.8 (SCN10A)

LOA: 51%

Vertex Pharmaceuticals Incorporated (VRTX)

Event Phase: II

Drug: VX-880

Indication: Diabetes Mellitus, Type I

Molecule: Cellular

Target: Insulin Receptor, Stem Cells/Other Cell Therapies

LOA: 17%

Partner Companies: Novartis AG (NVS)

AbbVie Inc. (ABBV)

Event Phase: II

Drug: ABT-981

Indication: Hidradenitis Suppurativa

Molecule: Monoclonal Antibody

Target: IL-1 (Interleukin-1)

LOA: 33%

Tiziana Life Sciences plc (TLSA)

Event Phase: II

Drug: Foralumab

Indication: Multiple Sclerosis (MS)

Molecule: Monoclonal Antibody

Target: Cluster of Differentiation 3 (CD3)

LOA: 12%

Partner Companies: AstraZeneca PLC (AZN), Bristol Myers Squibb Company (BMY), Light Chain Bioscience, Precision BioSciences, Inc. (DTIL)

Eli Lilly and Company (LLY)

Event Phase: I

Drug: Mazdutide

Indication: Obesity

Molecule: Peptide

Target: GLP-1 Receptor, Glucagon Receptor

LOA: 15%

Partner Companies: Innovent Biologics, Inc. (1801)

ORIC Pharmaceuticals, Inc. (ORIC)

Event Phase: I

Drug: ORIC-944

Indication: Prostate Cancer

Molecule: Small Molecule

Target: EZH1/2

LOA: 5%

Partner Companies: Mirati Therapeutics, Inc. (MRTX)

Cybin Inc. (CYBN)

Event Phase: Development Outside U.S.

Drug: CYB004

Indication: Generalized Anxiety Disorder (GAD)

Molecule: Small Molecule

Target: Serotonin 5-HT2A receptor

Ironwood Pharmaceuticals, Inc. (IRWD)

Event Phase: Approved

Drug: Linzess

Indication: Chronic Idiopathic Constipation

Molecule: Peptide

Target: Guanylyl cyclase c Receptor

LOA: 100%

Partner Companies: AbbVie Inc. (ABBV), Astellas Pharma, Inc. (4503:JP), AstraZeneca PLC (AZN)

Marker Therapeutics, Inc. (MRKR)

Event Phase: II

Drug: MT-401

Indication: Acute Myelogenous Leukemia (AML)

Molecule: Cellular

Target: Melanoma antigen-encoding gene (MAGE), NY-ESO-1 (Cancer-testis antigen), PRAME/MAPE/OIP4, Stem Cells/Other Cell Therapies, Survivin, Synovial Sarcoma X (SSX) Breakpoint Family, T lymphocytes

LOA: 11%

Financing events

Cypre

Description: Developer of hydrogel patterning technology and a model designed to improve the process of cancer drug development and precision medicine. The platform uses patented three-dimensional bioprinting technology and proprietary methods for assaying immunotherapy efficacy.

Verticals: Life Sciences, Oncology

Deal Date: January 10, 2024

Deal Type: Later Stage VC

Deal Size: $1.68 million

Investors: Undisclosed

Deal Synopsis: Cypre raised $1.68 million in venture funding from undisclosed investors.

LB Pharmaceuticals

Description: Operator of a drug development company focusing on treating schizophrenia using a pro-drug approach to change the chemical structure of amisulpride, creating a novel asset to improve efficacy and safety.

Verticals: Life Sciences, LOHAS & Wellness

Deal Date: January 10, 2024

Deal Type: Later Stage VC

Deal Size: $110.73 million

Investors: Pontifax Venture Capital (Ran Nussbaum) and undisclosed investors

Deal Synopsis: LB Pharmaceuticals raised $110.73 million in venture funding, including convertible notes converted to equity.

Myrobalan Therapeutics

Description: Developer of a therapeutic biotechnology company focused on developing oral neurorestorative therapies to reverse key pathologies underlying brain dysfunctions and CNS conditions.

Verticals: HealthTech, Life Sciences

Deal Date: January 10, 2024

Deal Type: Early Stage VC

Deal Size: $24 million

Investors: Co-Win Ventures (Xin Huang), AB Magnitude Ventures Group, 3E Bioventures Capital, Guanzi Capital

Deal Synopsis: Myrobalan Therapeutics raised $24 million in Series A funding led by Co-Win Ventures.

Sus Clinicals

Description: Developer of novel therapeutics aiming to accelerate medical discoveries using pig-based preclinical testing services for potentially life-saving cancer therapeutics.

Verticals: HealthTech, Life Sciences, Oncology

Deal Date: January 10, 2024

Deal Type: Seed Round

Deal Size: $3.50 million

Investors: Undisclosed

Deal Synopsis: Sus Clinicals raised $3.50 million in seed funding from undisclosed investors.

Aiolos Bio

Description: Operator of a clinical-stage biopharmaceutical company focusing on addressing unmet treatment needs for patients with respiratory and inflammatory conditions.

Verticals: Life Sciences

Deal Date: January 9, 2024

Deal Type: Merger/Acquisition

Deal Size: $1 billion

Investors: GSK (LON: GSK)

Deal Synopsis: Aiolos Bio reached a definitive agreement to be acquired by GSK (LON: GSK) for $1 billion.

Avamed Synergy

Description: Operator of a deep-tech company promoting research projects for technology transfer to the health sector using data, AI, and machine learning to enhance intraoperative surgical imaging and decision-making.

Verticals: Artificial Intelligence & Machine Learning, Big Data, HealthTech, Life Sciences

Deal Date: January 9, 2024

Deal Type: Later Stage VC

Deal Size: Undisclosed

Investors: In the process of raising venture funding on an undisclosed date.

Bolden Therapeutics

Description: Operator of a biotechnology company aiming to improve the lives of patients suffering from neurodegeneration by developing a therapeutic compound to promote the birth of new neurons in the adult brain.

Verticals: Life Sciences

Deal Date: January 9, 2024

Deal Type: Later Stage VC

Deal Size: Undisclosed

Investors: LifeSpan Vision Ventures (Andrew Worden)

Deal Synopsis: Bolden Therapeutics raised an undisclosed amount of venture funding from LifeSpan Vision Ventures.

Cerillo

Description: Developer of biological laboratory instruments simplifying common biological research tasks. The instruments include a multiwell plate reader designed to work in small labs.

Verticals: Life Sciences, Manufacturing

Deal Date: January 9, 2024

Deal Type: Later Stage VC

Deal Size: $1.35 million

Investors: Undisclosed

Deal Synopsis: Cerillo raised $1.35 million in venture funding through convertible debt.

Mabtech

Description: Developer of antibodies to cytokines, immunoglobulins, and apolipoproteins, providing efficient tools for the global scientific community.

Verticals: Life Sciences

Deal Date: January 9, 2024

Deal Type: Buyout/LBO

Deal Size: $328.84 million

Investors: EQT (STO: EQT) (Michael Bauer)

Deal Synopsis: Mabtech entered into a definitive agreement to be acquired by EQT through a $328.84 million LBO.

Mesenbio

Description: Operator of a biopharmaceutical company streamlining the process of discovery in the field of cell-derived therapy and basic biology.

Verticals: Life Sciences

Deal Date: January 9, 2024

Deal Type: Early Stage VC

Deal Size: EUR 1.4 million

Investors: DSW Ventures, NG Bio (UK) (Jason Goldstein)

Deal Synopsis: Mesenbio raised EUR 1.4 million in venture funding led by DSW Ventures and NG Bio (UK).

Okogen

Description: Developer of an ophthalmic specialty platform treating unmet needs in ophthalmic infectious diseases.

Verticals: Life Sciences, LOHAS & Wellness

Deal Date: January 9, 2024

Deal Type: Later Stage VC

Deal Size: $213,020

Investors: Undisclosed

Deal Synopsis: Okogen raised $213,020 in venture funding from undisclosed investors.

Transition Bio

Description: Operator of a biotechnology company building a hypothesis-free drug discovery and diagnostics platform for human health care advancement.

Verticals: Artificial Intelligence & Machine Learning, HealthTech, Life Sciences

Deal Date: January 9, 2024

Deal Type: Early Stage VC

Deal Size: $6 million

Investors: Undisclosed

Deal Synopsis: Transition Bio raised $6 million in venture funding through convertible debt.

Triplebar

Description: Operator of a biotechnology platform offering the power of evolution and the world's first microprocessor for biology. The platform leverages biotechnology for research and development to improve the sustainability of food supply production, processing, and packaging.

Verticals: CleanTech, HealthTech, Life Sciences

Deal Date: January 9, 2024

Deal Type: Early Stage VC

Deal Size: $21 million

Investors: Synthesis Capital (Boston), The Production Board (David Friedberg), Essential Capital, iSelect Fund, Rabobank Group, Stray Dog Capital

Deal Synopsis: Triplebar raised $21 million in Series A funding led by Synthesis Capital (Boston).

Ambrx (NAS: AMAM)

Description: Clinical-stage biologics company focused on discovering and developing engineered precision biologics (EPBs) using proprietary expanded genetic code technology.

Verticals: Life Sciences, Oncology, SaaS

Deal Date: January 8, 2024

Deal Type: Merger/Acquisition

Deal Size: $2 billion

Investors: Johnson & Johnson (NYS: JNJ) (Yusri Elsayed)

Deal Synopsis: Ambrx Biopharma Inc reached a definitive agreement to be acquired by Johnson & Johnson for $2 billion.

C2i Genomics

Description: Developer of a cancer treatment intelligence platform monitoring cancer recurrence by analyzing subtle changes in the pattern of the tumor's DNA.

Verticals: HealthTech, Life Sciences, Oncology, SaaS

Deal Date: January 8, 2024

Deal Type: Merger/Acquisition

Deal Size: $95 million

Investors: Veracyte (NAS: VCYT) (Marc Stapley)

Deal Synopsis: C2i Genomics reached a definitive agreement to be acquired by Veracyte for an estimated $95 million.

Cumulus Oncology

Description: Developer of novel therapies for treating cancers, focusing on an oral, selective, and preclinical Chk1 kinase inhibitor to optimize efficacy and outcomes for cancer patients.

Verticals: Life Sciences, Oncology

Deal Date: January 8, 2024

Deal Type: Seed Round

Deal Size: £9.00 million

Investors: Eos Advisory (Andrew McNeill), The Scottish National Investment Bank (Paul Callaghan)

Deal Synopsis: Cumulus Oncology raised £9.00 million in a seed funding round led by Eos Advisory.

Elephas

Description: Operator of a live tumor imaging diagnostics company determining cancer therapy for each patient using advances in cancer biology, microscopy, engineering, and artificial intelligence.

Verticals: Artificial Intelligence & Machine Learning, Life Sciences, Oncology

Deal Date: January 8, 2024

Deal Type: Early Stage VC

Deal Size: $51.22 million

Investors: Undisclosed

Deal Synopsis: Elephas raised $51.22 million in venture funding.

Gallant (Biotechnology)

Description: Developer of a pet health technology platform providing stem cell therapy for pets to treat diseases using regenerative medicine.

Verticals: HealthTech, Life Sciences, Pet Technology

Deal Date: January 8, 2024

Deal Type: Later Stage VC

Deal Size: Estimated $15 million

Investors: Bold Capital Partners (Teymour Boutros-Ghali), Digitalis Ventures (Cynthia Cole), Hill Creek Holdings

Deal Synopsis: Gallant raised an estimated $15 million in Series A funding led by Bold Capital Partners.

Jazz Pharmaceuticals (NAS: JAZZ)

Description: Ireland-domiciled biopharmaceutical firm focused on treatments for sleeping disorders and oncology, with a portfolio including Xyrem, Xywav, Zepzelca, Rylaze, and Vyxeos.

Verticals: Life Sciences

Deal Date: January 8, 2024

Deal Type: Debt Refinancing

Deal Size: $2.72 billion

Investors: Undisclosed

Deal Synopsis: Jazz Pharmaceuticals entered into a definitive agreement to raise $2.72 billion in debt refinancing.

MBF Therapeutics

Description: Developer of a DNA vaccine platform creating products for the infectious disease animal health markets, translating T-cell vaccines to elicit protective immunity against infectious diseases.

Verticals: Life Sciences, Oncology

Deal Date: January 8, 2024

Deal Type: Later Stage VC

Deal Size: $105,000

Investors: Undisclosed

Deal Synopsis: MBF Therapeutics raised $105,000 in venture funding through a combination of debt and equity.

Relay Therapeutics Inc (NAS: RLAY)

Description: Clinical-stage precision medicine company transforming drug discovery through the Dynamo platform, integrating computational and experimental technologies. Focus on precision oncology and genetic disease with pipeline candidates RLY-4008, RLY-2608, and GDC-1971 (formerly RLY-1971).

Verticals: Digital Health, HealthTech, Life Sciences, Oncology

Deal Date: January 8, 2024

Deal Type: PIPE

Deal Size: $30 million

Investors: Nextech Invest (Kanishka Pothula)

Deal Synopsis: Relay Therapeutics is in discussions to receive $30 million in development capital from Nextech Invest through a private placement. The funds will be used to advance RLY-2608 towards registrational trials, progress preclinical pipeline programs, and for general corporate purposes. The private placement is expected to close by January 10, 2024.

Solid Biosciences Inc (NAS: SLDB)

Description: Life science company manufacturing specialty and generic drugs, with a focus on curing Duchenne muscular dystrophy (DMD), a genetic muscle-wasting disease affecting primarily boys.

Verticals: Life Sciences

Deal Date: January 8, 2024

Deal Type: PIPE

Deal Size: $93.86 million

Investors: Adage Capital Management, Bain Capital Life Sciences (Adam Koppel), Deerfield Management, Janus Henderson Investors (NYS: JHG), Perceptive Advisors (Adam Stone), RA Capital Management (Rajeev Shah), The Invus Group, Vestal Point Capital

Deal Synopsis: Solid Biosciences is in discussions to receive $93.86 million in development capital from various investors through a private placement. The net proceeds will be used for ongoing pipeline development, business development activities, and general corporate purposes.

Zealand Pharma A/S (CSE: ZEAL)

Description: Biotechnology company focused on discovering, designing, and developing peptide-based medicines. Product pipeline includes candidates for short bowel syndrome (SBS), diabetes management, and treatment of congenital hyperinsulinism.

Verticals: Life Sciences

Deal Date: January 8, 2024

Deal Type: PIPE

Deal Size: DKK 1.45 billion

Investors: Undisclosed

Deal Synopsis: Zealand Pharma is in discussions to receive DKK 1.45 billion in development capital from undisclosed investors through a private placement. The funds will be used to strengthen Zealand's investment in its assets targeting obesity.

Calypso Biotech

Description: Developer of monoclonal antibodies for the treatment of immune pathologies with a focus on controlling homeostasis. Offers novel therapies for severe gastrointestinal diseases, including gastric and pancreatic cancer.

Verticals: Life Sciences, Oncology

Deal Date: January 7, 2024

Deal Type: Merger/Acquisition

Deal Size: $425 million

Investors: Novartis (SWX: NOVN) (Richared Siegel)

Deal Synopsis: Calypso Biotech reached a definitive agreement to be acquired by Novartis (SWX: NOVN) for $425 million.

Reduction in force (RIF)

January 10 - C4 Therapeutics: Two months after discontinuing one of its cancer assets, the small molecule medicines biotech has revealed a 30% workforce reduction, impacting a total of 45 positions. Story

January 8 - Affimed: Affimed is dissolving its research and preclinical development teams, cutting 50% of its staff as a result. The company says all funds will go toward its clinical-stage programs, which include a package of innate cell engages. Release

January 8 - Exelixis: Around 175 Exelixis employees are heading for the exits in the coming months, a workforce reduction that represents 13% of the company's total workforce. Story

January 8 - Organon: In the fourth quarter of 2023, Organon implemented restructuring activities across certain markets and functions which impacted about 3% of employees, a company spokesperson told Fierce Biotech via email on Jan. 8

Disease of the week

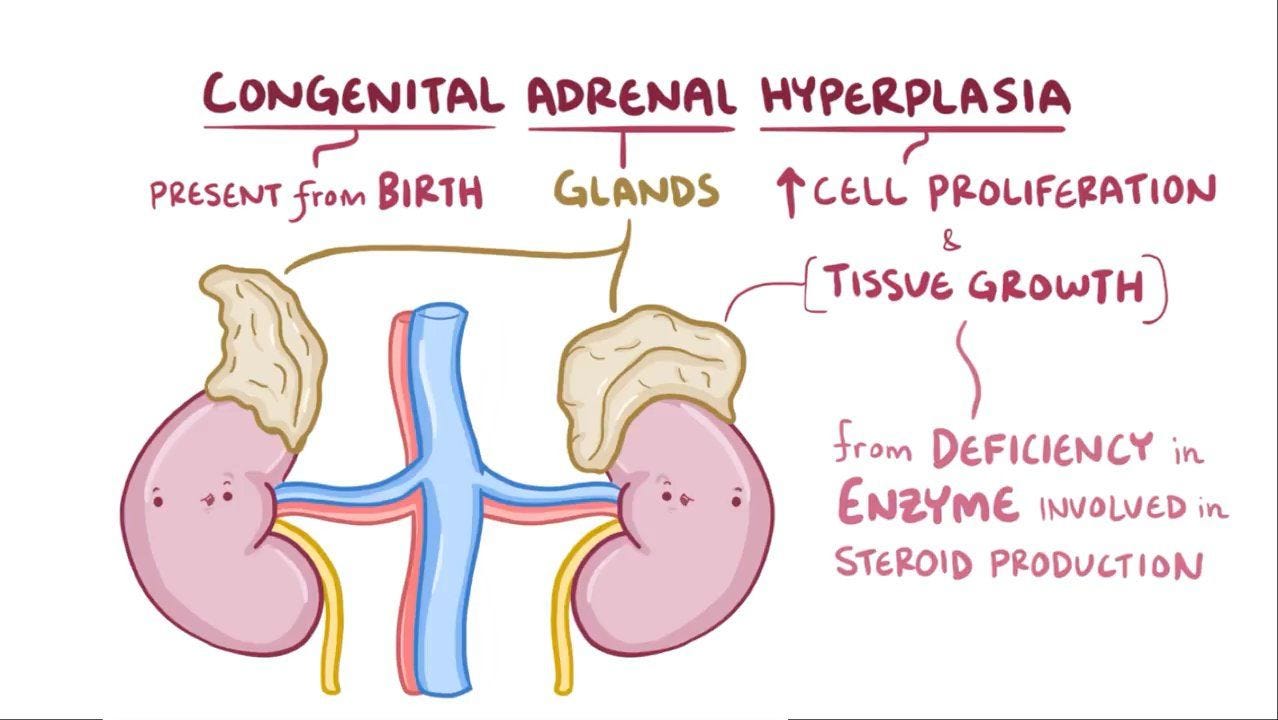

Congenital Adrenal Hyperplasia (CAH):

1. Definition:

CAH is a group of genetic disorders affecting the adrenal glands, leading to hormonal imbalances.

2. Genetic Basis:

Most cases are caused by mutations in the CYP21A2 gene, leading to deficiencies in the enzyme 21-hydroxylase, critical for cortisol and aldosterone synthesis.

3. Hormonal Imbalance:

Insufficient cortisol and aldosterone production.

Accumulation of precursors, causing excess androgen (male sex hormone) production.

4. Types of CAH:

The most common form is 21-hydroxylase deficiency. Other types involve deficiencies in different enzymes.

5. Clinical Presentation:

Ambiguous Genitalia (in females): Excess androgens can cause atypical genital development.

Salt-Wasting Crisis (in severe cases): Deficiency in aldosterone leads to salt wasting, dehydration, and potential life-threatening complications.

Hirsutism (Excessive Hair Growth): Particularly in females.

Early Puberty: Due to elevated androgen levels.

Irregular Menstrual Periods (in females):

Virilization: Development of male secondary sexual characteristics in females.

6. Diagnosis:

Newborn Screening: Often identified through routine screening for elevated levels of 17-hydroxyprogesterone.

Genetic Testing: Confirms the specific enzyme deficiency.

7. Treatment:

Hormone Replacement Therapy: Cortisol and aldosterone replacement to manage hormonal imbalances.

Monitoring: Regular monitoring of hormone levels and growth.

Surgery (in cases of ambiguous genitalia): Corrective surgeries may be performed.

8. Management Challenges:

Lifelong management is essential.

Balancing hormone replacement to avoid under or over-treatment.

Addressing fertility and reproductive health concerns.

9. Psychological and Social Aspects:

Coping with the impact on appearance and sexual development.

Support for individuals and families dealing with a chronic condition.

10. Genetic Counseling:

Essential for families to understand the genetic basis and implications for future generations.

11. Research and Advances:

Ongoing research to improve treatment, understand genetic variations, and develop potential gene therapies.

12. Prognosis:

With proper management, individuals with CAH can lead relatively normal lives, but lifelong medical attention is necessary.

What I’ve read this week

*Click on the pic to read*

JPM24 is the biggest investor conference for biotech and pharma for those who don’t know.